Are you considering buying an apartment condo in London Ontario, or the surrounding area? Here are a few things to consider to help you make an informed decision.

I have viewed hundreds of apartment condos over the years. Buyers look at the size of the balcony, kitchen, and bathrooms.

How clean and tidy are the entrance, the lobby and the elevators?

Are the security, entrance, and monitoring systems operational and up to date with the latest equipment?

Are the elevators all operable and were they last inspected promptly?

If underground parking is available, I am looking for moisture, security systems, and odours.

Before You Make an Appointment To View an Apartment Condo in London Ontario, Find Out:

Who lives here? What age group? Children?

What are the average prices for the last 12-18 months?

What are the average days on the market for these condos?

How long has this unit been on the market & how many times?

Is planned construction nearby that will affect or disrupt views or traffic flow?

Before Making an Offer, Consider:

A Financing Clause, if necessary

A Home Inspection? Sometimes, it is unnecessary; I am concerned about the electrical, plumbing, heating, and cooling systems in an older building.

Ordering a Status Certificate—The financial situation of the condo corporation. Don’t just rely on your lawyer’s opinion. They know the law but are not accountants, financial advisers or Realtors.

What are the condo rules? (A good real estate lawyer will be able to tell you after reviewing the status report)

Are there pet restrictions? You may want to do that before buying a condo.

Ample visitor parking?

What is the percentage of units occupied by owners vs. renters? (A good real estate lawyer will be able to tell you after reviewing the status report)

Finding and selecting a condo in London, Ontario, can be an exciting experience. However, letting emotions cloud your judgement could prove costly or lead to dissatisfaction within a few months!

Like a meal or a piece of cake, it helps to know what ingredients make it great and in what order!

In a recent survey, 73.7% of apartment condo buyers said they wish they had known what they know now and would be more diligent in future purchases. That is why I wrote this.

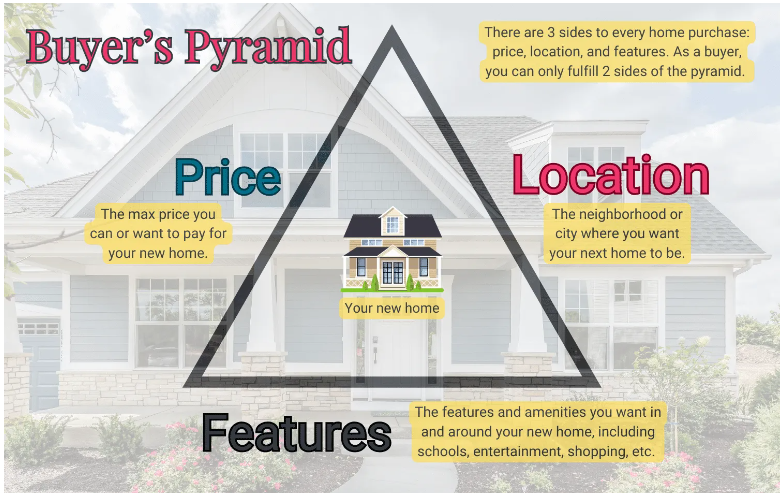

When you go shopping for a house or condo to buy, two homes are competing for your attention: the one that meets your needs, and the one that fulfils your desires.

Offering a Price Without The Correct Comparisons

What price do you offer a seller? Is the seller’s asking price too high? Is it ideal? Without conducting market research and reviewing comparable condos, you are bidding blind. A professional Realtor who represents you should offer an unbiased opinion on the place’s value based on market conditions and the building. I said they should, but how would you know if it is unbiased, what comparables are used, and in what time frames? Without this knowledge, you could quickly bid too high or miss a great buying opportunity.

Buying the wrong place.

What are you looking for in an apartment? It’s a simple enough question, but the answer can be pretty complicated. More than one buyer has been swept up in the emotion and excitement of the buying process, only to find themselves the owner of a place that is either too big or too small. Perhaps they didn’t consider the drive to work, the distance to school, or the many fixes they want to address now that the excitement has died. Take the time now to define your wants and needs, discuss them with your Realtor, put them in writing, and use them as a benchmark to evaluate every property you visit.

Unclear title

Before signing any documents, ensure the property you are considering is free of all encumbrances. Your lawyer will do this for you as part of their fiduciary duty, but please ensure your Realtor includes clauses to protect you. The last thing you want to discover before you move in is tax liens, debts, undisclosed owners, leases, contracts or easements or special assessments.

Unexpected repairs

Don’t expect every seller to disclose every physical detail that requires attention. Use common sense and double-check everything!

Unfortunately, anyone can call themselves a “Home Inspector,” and no Provincial Governing Body can monitor or verify credentials. I have seen some doozies, some unbelievable, erroneous, and some great reports over the years.

Not Getting Mortgage Pre-approval

Pre-approval is quick, easy and free. It’s essential to know in advance what you qualify for to avoid disappointment. Did you know that shopping for the best rate and terms could save you $50,000 or more over 20 years? Getting the best terms for you for a mortgage is more important than a condo’s price.

Note: Be careful with pre-approvals. Not all pre-approvals are the same.

Hidden Costs

There may be additional costs or fees you have not yet considered. A good Realtor will discuss this with you, and you should consult your lender, lawyer, and any other professional regarding all fees and costs.

Rushing the Closing

Take your time during this critical part of the process.

Do you understand your mortgage details?

Has anything been forgotten?

Do the paperwork and documentation reflect your understanding of the transaction?

Will your Realtor take you through your planned purchase 2 to 3 days before closing? (To ensure that there are no unusual changes in the condo’s condition or that is supposed to stay, stays).

Plan for Flexibility

Allow for contingencies and have a backup plan in place. If you or the sellers need more time to finalize the arrangements, keep these delays from becoming frustrating or upsetting.

If it’s not in Writing, It Doesn’t Exist.

Don’t make any assumptions or believe any assurances. Have your real estate professional keep an ongoing log (in writing) of all discussions and get the seller’s written approval for all agreements.

How long do you plan to live in the condo?

Buying & selling an apartment condo in London or anywhere, in fact, can cost money. If you may need to move in the short term, your property's value may not have been fully appreciated to cover the costs of buying and selling. The time required to cover those costs depends on various economic factors.

What features do you need to suit your current lifestyle? Five years from now? People tend to stay in places longer than they initially intended, primarily due to the time and cost of moving. Therefore, it is worth considering a home with room to grow. Having an idea of what you’ll need will help you find a place that meets your needs for years to come.

I left the best for last: Make sure you know what you want!

Knowing what you want may sound simple, but many buyers need a reality check before they start searching.

When buying an apartment condo in London, Ontario, you may fall in love with one or another one for entirely different reasons. Far too often, people buy a place for the wrong reasons and later regret their decision when the apartment condo fails to meet their needs.

Do not shop with stars in your eyes: satisfy your needs first. Work with a good Realtor who will sit down with you and listen to your wants.

To help you know what you want:

What do I NEED in my apartment condo?

1____________________________________________________________

2_____________________________________________________________

3_____________________________________________________________

4_____________________________________________________________

5_____________________________________________________________

What would I LOVE?

1_____________________________________________________________

2_____________________________________________________________

3_____________________________________________________________

4_____________________________________________________________

We bring people and properties together. We take the time to listen and understand your goals and concerns, then design a plan to achieve them and execute it.

When you’re ready to move, Michael or I, Ty Lacroix will make sure you do so safely, wisely and thriftily!