Everyone has an opinion about the real estate market in London Ontario. There are the so-called gurus, economists, real estate appraisers, mortgage providers, Realtors, your dry cleaners, Uncle Bob, and the ever-present ‘they’!

How can you accurately tell what the real estate market in London, Ontario, is like now?

Most think the price sold or asked is an indicator; unfortunately, it’s not the best way to risk your hard-earned money! Or on interest rates or a time of the year.

Here are two indicators that correctly show the real estate market’s current state, not its future or potential.

Months of Inventory:

Months of Inventory quantifies the relationship between supply and demand. It is calculated by dividing the number of active home listings at each month’s end by the total number of home sales completed that month.

For example, if 100 active listings are available and 10 homes sold in the most recent month. Buyers can choose from approximately ten months of housing inventory. A healthy, balanced market will have 5 to 7 months of real estate inventory. Less than five months is a seller’s market, and more than five is a buyer’s market.

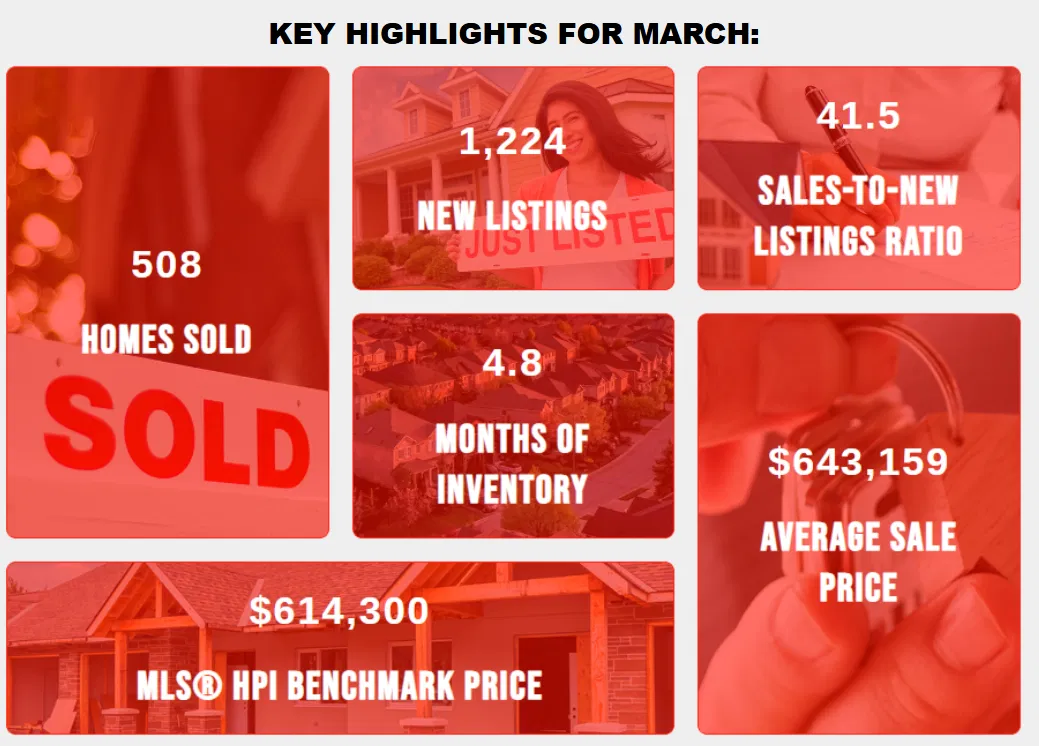

As of April 3, 2025, London, Ontario, and the area had 4.8 months of inventory (houses and condos for sale).

Absorption Rate:

The absorption rate measures supply and demand. Take the number of homes sold in a month and divide it by the number on the market. You will have a percentage that determines how quickly homes sell. An absorption rate greater than 20% is a seller’s market. An absorption rate below 15% is a buyer’s market.

As of April 9, 2025, our London St. Thomas Association of Realtors (LSTAR) reported 2066 active listings. So, take 508 homes sold divided by 2066 and get an absorption rate of 25%, a buyers’ market.

The facts and only the facts.

We humans tend to make choices emotionally!

Getting back to who do you believe, I end this blog with a Mark Twain quote. “The difference between fiction and reality is that we expect fiction to make sense!”

Note: Caveats:

Absorption rates and inventory rates are practical measurements of the London Ontario real estate market, but practicality is useless when the observing eye knows more than the perceiving eye!

Example 1

“Ty, if a place ever comes up on _________________ street, let us know.” I did. The house was immaculate and $127,000 higher in price than any of the recent sales in the neighbourhood. We put in an offer, and two others did as well. Regardless, my client got it, and we paid over the asking price. It was ideal for their lifestyle and comfort zone.

We listed their home in an area with four comparable properties and a $76,000 price difference between them. My client’s home sold in five days for full price.

Now, I could write that my skills and experience made it happen, but that would be b.s. My clients knew what they wanted, did not care what the market was or would be and acted with conviction. I was along for the ride!

Example 2

Three townhouses in an enclave of townhouses are almost identical in size, quality, and layout, and they have three prices: $590,000, $625,000, and $665,000. Guess which one sold? Guess which two are still on the market?

My Point?

Regardless of the market, everything will sell. It all comes down to perception and reality; eventually, one will rule!